Jump in group plan premiums is projected to be the largest since 2011

By Stephen Miller, CEBS

Sep 26, 2017 - SHRM

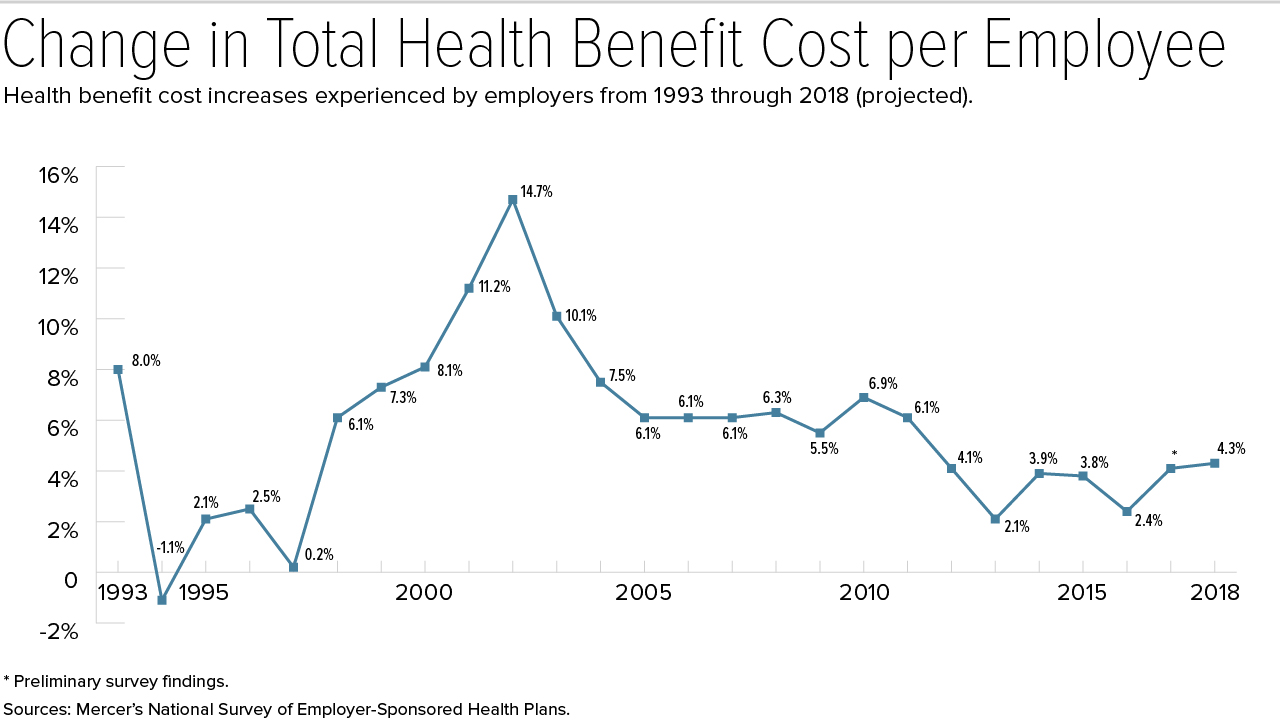

Employers will see a 4.3 percent increase in health benefit costs next year after they make planned changes such as raising deductibles or switching carriers, according to early responses from HR consultancy Mercer's 2017 National Survey of Employer-Sponsored Health Plans.

Over the past five years, Mercer's surveys have found that the average annual increase for employer-sponsored health plans has been about 3 percent; an increase of 4.3 percent would be the highest since 2011, when costs rose 6.1 percent.

The increase employers would expect if they made no changes to their medical plans is 6 percent. However, the survey found that 46 percent of employers will take steps to reduce cost growth in 2018, such as offering lower-cost, high-deductible health plans.

Mercer's preliminary results are based on approximately 1,500 mostly large U.S. employers that responded to the survey by Aug. 15.

"Employers must contend with cost increases that occur with medical advances, like the introduction of new medications used to treat complex conditions like cancer, multiple sclerosis and hepatitis C," said Tracy Watts, senior partner and Mercer's leader for health reform.

Strategies that employers are adopting to manage medical costs without raising employee out-of-pocket spending, Watts said, include:

|

Keeping an Eye on

the Cadillac Tax With the Affordable Care Act's 40 percent excise tax on high value group health plans (the "Cadillac tax") slated to take effect in 2020, employers may have to pick up the pace of change to try to stay ahead of cost increases. Mercer estimates that 31 percent of large employers (500 or more employees) would be liable to pay the excise tax in 2020—and with the tax threshold indexed to inflation and rising at about half the rate of health benefit cost, more employers would pass the threshold each year. "The excise tax creates pressure to generate immediate cost savings though cost-shifting or other short-term fixes," said Beth Umland, Mercer's director of research for health and benefits. But employers are also making good progress with longer-term strategies that address the root causes of high cost and cost growth," she noted. The Society for Human Resource Management is working with Congress to repeal the

tax. |

Another View

Jump in Drug Prices Is Less Steep

Segal Consulting, an HR advisory firm, highlighted some good news for health benefit sponsors. Prescription drug cost growth will be lower for 2018, the firm predicts, reversing a multiyear trend of ever-bigger annual price jumps.

Segal's Fall 2017 report on prescription cost trends is based on a survey of

more than 100 health insurance providers, conducted during the summer of

2017.

In recent years, increased use of generic drugs "has helped mitigate prescription cost increases," and it's become more common for pharmacy benefit management (PBM) firms to exclude high-cost specialty drugs from their formulary and offer therapeutically equivalent generic alternatives, said Edward Kaplan, national health practice leader at Segal.

"Plan sponsors should continue to aggressively negotiate and renegotiate their PBM contracts to help manage the prescription costs," advised Eileen Pincay, Segal vice president and senior pharmacy consultant.

Health Premiums Higher at Small Employers

Employees who receive health coverage through smaller employers generally must pay more to cover their families, according to findings from the nonprofit Kaiser Family Foundation's (KFF's) 2017 Employer Health Benefits Survey, released in September.

"Small firms are much less likely to offer health benefits to their workers, and when they do, workers may find it quite costly to enroll their families," said study lead author Gary Claxton, a KFF vice president.

The survey was conducted with the nonprofit Health Research and Educational Trust (HRET) between January and June 2017 and included 3,938 private firms with three or more employees. Among the findings:

The data are more mixed for workers enrolled in single coverage:

In August, United Benefit Advisors (UBA), a network of independent employee

benefits advisory organizations, reported that small businesses are passing on to

employees nearly 6.6 percent more of the costs for single coverage and

nearly 10 percent more of the costs of family coverage compared

to large firms.

Those numbers increase to 17.8 percent more of the costs for single

employees and over 50 percent more for family coverage when you

compare small employers to their largest counterparts—those with more than 500

employees—noted Bill Olson, chief marketing officer at UBA.

|

Average Single Monthly Premium (All Plan Types):

Average Family Monthly Premium (All Plan

Types):

Source: United Benefit

Advisors. |

Premiums Differences by Plan Types

|

2017 Average Annual Employer and Worker Premium Contributions | |||

|

Plan Type |

Total Average Annual Premiums |

Single coverage premium contributions (employer / worker) |

Family coverage premium contributions (employer / worker) |

|

PPO |

Single: $6,965 Family: $19,481 |

$5,653 / $1,312 |

$13,430 / $6,050 |

|

HDHP |

Single: $6,024 Family: $17,581 |

$5,004 / $1,020 |

$12,982 / $4,599 |

|

All Plans |

Single: $6,690 Family: $18,764 |

$5,477 / $1,213 |

$13,049 / $5,714 |

|

Source: Kaiser Family Foundation and Health Research and Education Trust. | |||